The design of money

Money is so present that we tend to forget that its conception, creation, distribution and use are not immutable and fatal facts, but choices of civilization.

I have been working on this subject and experimenting with money for more than 6 years now. And I have noticed two things:

very few people realize that the current way we deal with money is recent, arbitrary, and regularly changes of modalities,

when it comes to money, people's tempers flare very quickly.

Indeed, in a world where control of money is only the luxury of a very small elite and where, generally, it is kept in a state of scarcity for the majority, discussions about it quickly reveal how it generates fear, stress and anxiety in us.

I am therefore tempted here to put money in its current expression (debt-money, as it is created from the indebtedness of the people) through the 7 sieves that allow us to evaluate how synergetic something is in its design (you will find the details in the about section).

Is debt-money efficient?

Is the way money is managed efficient given what it offers in return? I would say it's pretty bad.

On the one hand, it is very easy to generate, since all that is needed is a few computers and the people agree to go into debt, either individually or through their states (thanks to fractional reserve banking, it is possible to create as much money as desired from nothing, since the limits of these fractional reserves are modulated at will by the people who create the debts).

On the other hand, since the banking authorities keep the people under repayment pressure with the support of the law enforcement agencies and most governments, its mere existence forces us into monotropic capitalism, i.e. to seek capital accumulation by all possible means, including the least synergetic, in order to repay our debts.

This means that in order to be able to generate money for the use we are interested in (housing, food, education, leisure, etc.), we usually have to perform entropy-intensive tasks. Why do I say that this entropy is substantial? Because most human activities today are. This is mainly due to the general state of unhappiness, ignorance and the current systems that leave very little room for real alternatives, mostly thanks to mass propaganda.

This is the case for example with high technology, which invests our lives at high speed and which is generally imposed on us without our consent (see the article “Technolucidity: where Amish are right”).

As for the efficiency of debt money, we can conclude that its very model is efficient (the production of money is simple and can be in theory as abundant as needed) but that the way it is purposely applied in our world generates a lot of entropy. This does not disqualify the efficiency of the debt-money model, but the efficiency of the debt-money model of our time.

Is debt-money accessible?

A little yes and a big no.

Indeed, it is easy on Earth to have access to money in small quantities: trade is everywhere and so are the banks. We can find small paid jobs everywhere.

However, because of the extensive use of computer hardware for its management, the current monetary system is very greedy in rare materials and electrical energy.

The cash money tends to temper these remarks since it is possible to use it without ever resorting to a computer. However, its value depends on the global financial system and even if it would be possible for people to ignore it to some extent, the fact is that they do not.

Access to money on a large scale is, on the other hand, difficult, mainly because humans tend to want to distinguish themselves socially and appreciate being richer than others. It can also be observed that many people appreciate that there are wealthier and more powerful people than they are. This is at the origin of social classes and of systemic curbs on capital accumulation for the less fortunate bangs of the population.

And finally, the main element that considerably reduces the accessibility of money is its protection by states and lobbies. This has long been the most jealously guarded element by potentates, and the penalties for counterfeiting are colossal (often considered as high treason at certain times as in England, or a crime of lèse-majesté, as in France).

Is debt-money transparent?

Once again, in principle, this could be the case, but in the current system, opacity is everywhere, starting with the banking software of which almost nobody knows the content and which regularly records spectacular bugs.

In the same way that the data and metadata generated by our uses of money are exploited in an opaque way and undoubtedly give rise to non-synergetic activities.

Is debt-money predictable?

The answer is simple: only for the people that really control it. So, mostly, it is not predictable at all.

Proof is the countless financial crises that take place in the world constantly and that no people is able to predict enough to at least not suffer too much from it. Not to mention the countless "financial experts" who are very regularly wrong about how things are going.

If you are interested in knowing more about how the system is predictable, but only for the head of the banking system itself, don’t hesitate to read The Secrets of the Federal Reserve from Eustace Mullins.

Of course, you can rely on other people to get some clues about how economy will behave, but the problem remains: the levers are not on the side of the majority users and in such an opaque and arbitrary way that we can participate in non-synergetic activities despite ourselves.

Is debt-money simple?

It could be, but it is not. To completely understand the financial system is really difficult and takes a lot of time. The principle of debt itself is not quite understood.

For instance, a simple mathematical projection shows that any debt contracted with interest in this system cannot be repaid by money, because the excess money demanded by the interest does not exist.

Current debt = n*(capital+interests)

Current money in circulation = n*capital

Current debt - Current money in circulation = n*interests

Many people can't wrap their heads around this simple truth.

The illusion of repayment is due only because it comes in the form of small cells (individual, family, village), but as a whole, debts can be repaid by only one means: a counterparty that the banks will recognize as having value. This can be land, businesses and even slavery.

Indeed, in a system of generalized debt-money, under repayment stress and led by a few, all those who are not part of the banking cenacle tend to become its slaves sooner or later.

Sure, this one is simple! But the current financial system as a whole is not.

Is debt-money reversible?

Yes... but!

Reversibility of money is to understand here in the sense that its use once allows other uses then. If you pay something, the money spent remains usable and can be given back to you.

Debt-money as such is therefore very reversible and reusable: it is fungible, storable and there is always a way to make it accepted somewhere against a good or a service.

However, two things limit its reversibility:

financial crises, which can mean that money that used to buy a house yesterday can today only be used to buy a sandwich,

taxes!

Indeed, the proper of money in the current system is that it is taxed thousands of times at almost every gain and expense.

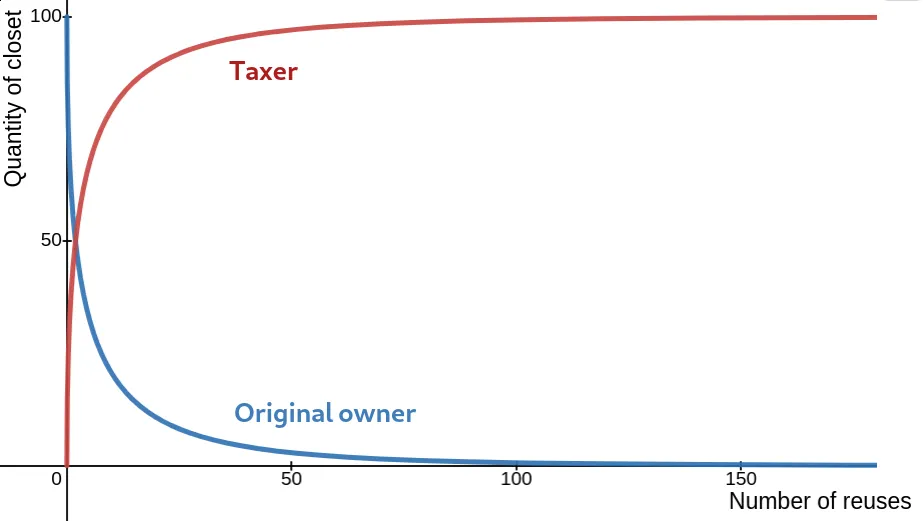

It is as if every time we dismantle a closet to make something else, we have to give one of its boards to the state or to the banks (which is about the same in the end nowadays). As it is often proportional, the smaller the closet, the smaller the amount of wood to be donated, but the inevitable outcome of the transformation of the closet in an infinite future is its disappearance.

This sounds less like a trickle-down theory than a funnel theory!

The practical reversibility and reusability of the current debt-money we daily use is therefore quite low for us (but not for the taxer of course!).

As for the financial crises of which most people are innocent because of their understandable ignorance of the matter and because of a system they never asked for, it is as if from one day to the next the big cupboard of our grandparents that we had planned to dismantle had shrunk to a small bedside table.

Are we content with debt-money?

It may be tempting to say "No, not at all! Look at all the people complaining about their money problems!" but that would be going a bit fast.

In fact, it would be better to first find out what people really want. Because, even if we tend to complain and grumble about it when we have the opportunity, it is obvious that most people at the moment are very attached to the current economic model.

After many years of discussing the issue and proposing alternative solutions, the feedback I got reinforced my feeling that history is played out through active minorities, and that the rest of the people follow, whether they are really and deeply happy with the situation or not (we can still consider that if they consent, they are somewhat satisfied with the situation, otherwise they would genuinely react to change the situation, like when they face starvation for example).

So we have a choice to make:

force people to follow another model assuming that they will be happier with it than they are now (which is impossible to prove),

allow alternatives that can be reached by consent to exist for good.

The second one seems to be better as long as it is possible. The first one is a classic history move but tend to recreate the same issues over and over. True multipolarity is the most satisfying option in every case in my opinion.

Last, but not least, the biggest problem we face when talking about money and put into practice real alternatives is our psychological conditioning. Our fears in this matter are extremely powerful and often prevent us from seeing the best outcomes.

Toward a synergetic money

I would like now to propose something. Let’s take the seven criteria to help us highlight what a synergetic money would look like (I called it syn-money to keep it short):

Efficiency: the syn-money has to be easy to create and manage and the way it is created shall not lead to a loss of trust, leading to devaluation and uselessness. So we have to find a trustworthy way to ensure the value of the money for the people involved in its use.

Accessibility: the elements needed to create and manage the syn-money shall be built with common material, no patent shall restrict its use. So, free licenses are necessary and as less high-tech as possible to avoid technological centralization (when just a few are really able to manage a solution).

Transparency: nothing from the syn-money shall prevent someone to know how it works. Therefore, comprehensive public sources are needed.

Predictability: it does not seem necessary to try to predict how the syn-money will be use, as it would demand in fact extensive data and research about people and not the money itself, but the way it is created and managed has to be predictable. In case unpredictability is introduced for some reason (like with some cryptocurrencies where mining is predictable but not which computer will mine the next block, guaranteeing no takeover), it has to be predictably bounded, meaning that the needed calculation related to the syn-money is feasible at anytime (the only one really necessary seems to be how much money should be created, where and following which rules). Another thing: being rich or poor shall not give any form of power over the money. Its control has to remain for everyone, meaning no one in particular. Wealth does not ensure synergy and I’ll probably come back later on this one.

Simplicity: the syn-money has to stay as simple as possible to prevent a bias due to a form of geniocracy (that does not mean “a form of government where the guys have always the best ideas for everyone”). You don’t have to be intelligent to be relevant and if we keep things simple we increase our chances to see someone express a good idea about them.

Reversibility: the syn-money has to be fungible, storable and freely exchangeable (no taxes on deposit or transactions).

Contentment: I think the best way to optimize contentment of people regarding money is: the less you think about it, the best. What I mean is money is above all a mean to an end, not an end by itself (except when the human capitalist tendency becomes a sort of disease). We begin to think about it when we lack it. So, syn-money should be as abundant as possible without compromising its trustworthiness. It can also be a community money, like a religious one, an ethnic one, a fanclub one, etc. What matters is if it fits its purpose (human contentment) without creating unsynergetic situations. It is also important that coexisting syn-currencies are not detrimental to each other. Otherwise, they would lose their efficiency.

One example worth trying

After such considerations, I ended up on a work that is called the Relative Theory of Money (you can find an English version here).

It is for now the most interesting approach I heard about and participate myself in the first cryptocurrency launched from this model.

EDIT: it is not anymore and I completely stopped using it. See why at the end of this article.

This currency is called Ğ1 and is for now mostly used in France and Spain so people living outside these countries can have some hard time connecting with users but it is far from impossible.

Here is the map where the biggest part of the people using this currency is:

In this model, the money is created by every member of a web of trust (each member is accepted by other members to be a part of the community of users) in the same way, at the same time. Money is not created then distributed, it is co-created, in a decentralized manner, based on multiple computer servers (like most cryptocurrencies but without the huge environmental cost as the currency is coded differently on this point).

Each member has a related wallet but it is also possible to create as many wallets as necessary and people that are not members can do too (only, these wallets will not co-create any money, unlike the members’ ones).

The mathematical formula a money creation ensure that there is no inflation or deflation due to the creation. It is balanced over time and between users.

The works are published under free licenses, allowing anyone to take a look at how the software is done and therefore how the money is created.

This model may suit different approaches. Some people who want universal income see it as a great opportunity to develop and promote it, others, like me, see it as a better way to foster innovation and value creation, without compromising competition, but without overvaluing it either, as in our current model.

You can find relevant information about the Ğ1:

This currency is still young and finding its pace, it has been launched in 2017.

It is a cryptocurrency and some of its aspects are quite technical and not easy to get but things are getting better and some people are working on creating a form of cash that could help spreading the use and dealing with the Ğ1 without needing to have a computer or a smartphone with internet all the time. There is also some efforts to make the use anonymous as it is a healthy prerequisit in a world of mass surveillance.

Having used it since the beginning of its launch, I have found it to be a functional currency, which does not encourage any particular political model other than the guarantee of a distributed and equitable money creation.

It does not disempower the users, on the contrary, since they are the ones who create the money by their existence and the fact of being mutually certified within the currency network.

And finally, it does not prevent competition and even favors it at a certain level since it tends to radically limit speculation games on money and prevents the monopolization of the power of money creation and its connections with some companies in particular and not the others.

IMPORTANT NOTE

Ğ1 was the best solution I had found when I wrote this article but it is not the case anymore. The disagreements I had with the dev team from the beginning of the project (mainly about privacy concerns) have reach a point of no-return since the last version of the software whose roadmap, published at the beginning of 2023, shows zero sign of friendliness toward people that seek for privacy in their use of money. I have also change my mind about the relevancy of trusting a monetary system. So I looked for another solution and I have found something that can be called the G.A.M.E (Garden of All Manner of Exchange), which is far better in my opinion, for a community trading system. See the following articles to know more: